Which is better, a PPF account or a fixed deposit? In India, state provident funds and fixed deposits are both common forms of investment. PPF offers tax advantages and a high interest rate, whilst FDs guarantee returns. Choosing between the two could be difficult, especially for inexperienced investors. To assist you in making an informed choice, we will examine the characteristics, advantages, and disadvantages of both investing options in this post.

FD VS PPF?

A fixed deposit is a sort of investment in which you make a one-time payment to a bank or other financial organization for a predetermined amount of time, usually a few months to many years. Interest is paid on the funds at a set rate that is decided upon at the time of investment. Both the principal and interest are paid to you at the conclusion of the term. Because they are not impacted by changes in the market, fixed deposits are thought to be a secure investment choice. Fixed deposits are a popular option for those looking to increase the return on their investments because their interest rates are typically higher than those of savings accounts. PPF is a provident fund is a government body to invest in to save tax and for long term saving plans. it is the most saver and higher rate of interest delivering invetment program. An individual is always advised to diversify their funds to gain profits.

About PPF Program

A PPF account is a savings plan supported by the government that has a high interest rate and tax advantages. Authorized banks and post offices are the places to open PPF accounts. The account holder cannot take money out of the account for 15 years because of the lock-in period.

The current yearly interest rate for PPF accounts, which is controlled by the government, is 7.1%. PPF accounts are a desirable investment choice for individuals seeking tax savings because the interest they generate is tax-free.

- Bihar Ayush MO Recruitment 2025

- Caste Census 2025 Notification

- IISER IAT Result 2025

- CBSE 12th Revaluation Result 2025

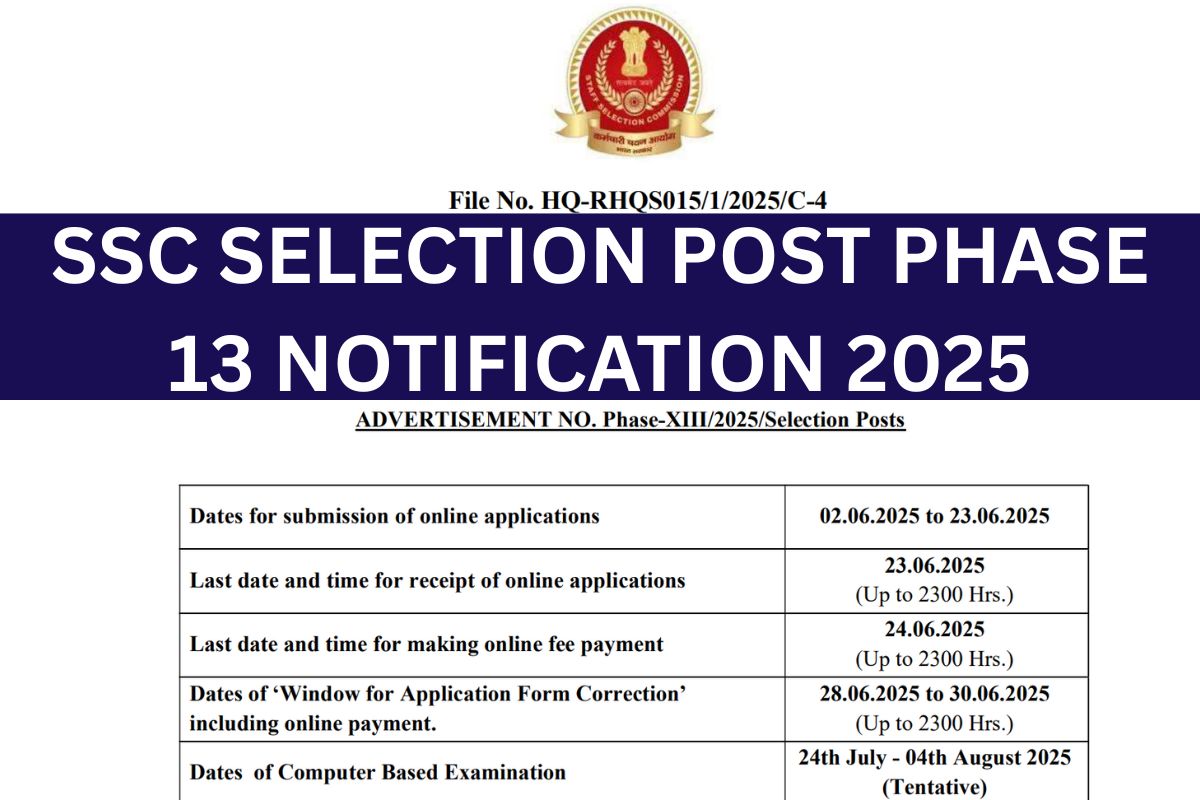

Also Read SSC Selection Post Phase 13 Notification 2025 – Application Form, Eligibility

SSC Selection Post Phase 13 Notification 2025 – Application Form, Eligibility

FD Vs PPF : Highlights

| Name Of Post | FD Vs PPF ? : Know Benefits & Pros & Cons |

| Type Of Investem | PF: Term DepositPPF: Long-term government-backed savings scheme |

| Tenure | PF:7 to 10 Days MinimumPPF: 15 Years |

| Level Of Risk | PF: Low RiskPPF: No Risk |

| Category | Finance AID |

Benefits of FD And PPF

Before making an investment, you should weigh the following advantages of PPF vs FD:

Advantages of FD

- A secure investment choice that is subject to financial institution regulation

- Guaranteed profits regardless of market swings

- FDs provide you the freedom to select an appropriate tenure.

- As compared to the savings accounts this Fixed Deposit offers you more interest.

- An extremely liquid investment that is susceptible to early withdrawal

- Choosing to invest in tax-saving FDs in order to receive section 80C tax benefits

- Possession of a loan secured by FD

Advantages of PPF

- Encouraged long-term savings with a 15-year lock-in period.

- PPF investments are extremely safe because the government backs them, and they have greater interest rates than typical fixed-instrument investments.

- A loan arrangement secured by PPF

- The interest rate is set for the duration of the term and is announced every three months.

- Extremely steady because PPF rewards are independent of market swings.

Pros Of FD and PFF

Fixed Deposit

- Ten years to seven days is a flexible tenure.

- Assured returns with fixed interest rate

- Easy liquidity and premature withdrawal (with penalty)

- Loan facility available against FD

- Suitable for short- to medium-term goals

Public Provident Funds

- EEEs (Exempt at Investment, Interest, and Maturity) are tax-free returns.

- Government-supported and extremely secure

- The best option for long-term growth is compound interest.

- After a certain number of years, partial withdrawals and loans are permitted.

- This is perfectly designed for long term savings.

Cons Of FD and PFF

Fixed Deposit

- Earned interest is subject to taxes.

- Long-term returns could be less than inflation.

- Penalties for early withdrawal

- Unsuitable for generating long-term wealth

- Unless it is a five-year tax-saving FD, there is no tax benefit.

Public Provident Funds

- 15-year lock-in term (after five years, only partial withdrawals are permitted)

- An annual maximum investment of ₹1.5 lakh

- Not being able to open several accounts in your name

- Government-fixed returns might not always outpace inflation.

- Unsuitable for urgent liquidity requirements

FAQ’s Related To FD Vs PPF?

Which is more secure, PPF or FD?

Because PPF has the support of the Indian government, it is safer.

Which provides greater tax advantages?

With tax-free returns under Section 80C, PPF provides superior tax advantages.

Can I invest in PPF and FD at the same time?

It is possible to invest in both at the same time.

For a short-term investment, which is better?

For short-term investment objectives, FD is preferable.

Which is more effective at creating money over the long run?

PPF is the best option for building money over the long run.

Is FD subject to taxes?

FD interest is, in fact, fully taxable.

Can I take my FD out early?

Yes, with an interest penalty.

Can I take an early PPF withdrawal?

After five years, a partial withdrawal is permitted under certain restrictions.

Can I borrow money against my FD?

The majority of banks do provide loans secured by FDs.